A GUIDE FOR NRIs RETURNING TO INDIA

- Sun Aug 11 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

The allure of the familiar— the enticing aroma of spices, the warmth of family gatherings, the vibrant chaos of Indian streets, the festivities and last but not the least, “Ma Ke Haath Ka Khana”, forever etched in our minds —often tugs at the hearts of Non-Resident Indians (NRIs), beckoning them back home. In recent years, an increasing number of NRIs have been choosing India as their retirement destination. This trend, often referred to as a "homecoming," is fuelled by a blend of emotional connections and practical considerations. The choice to retire in India goes beyond reconnecting with cultural roots and cherished memories; it is also driven by practical considerations such as lower living costs, affordable healthcare, and the chance to enjoy a more relaxed lifestyle .

However, alongside the excitement of this homecoming, Non-Resident Indians (NRIs) often encounter challenges, especially in navigating the financial landscape. Managing finances —including property investments, taxation, currency exchange, and pension transfers—can be a complex and daunting task. Ensuring a smooth transition necessitates careful planning and a thorough understanding of the financial implications of returning to India. “Homecoming” is a significant step that requires careful planning and preparation, especially when it comes to your finances.

By following these tips, you'll ensure a smoother transition and a more secure future.

1. Evaluate Your Finances: Start by assessing your current financial situation. Review your savings, investments, and debts. Knowing where you stand financially will help you make informed decisions as you plan your move back to India.

2. Manage Currency Exchange: Planning your currency exchanges is crucial to get the best rates. Consider timing and market trends to maximize your returns. Exchange rates can fluctuate, so keeping an eye on the market can save you money in the long run.

3. Transfer Your Funds: Use reliable transfer services that have low fees to transfer your funds to India. It's also essential to understand the tax implications and reporting requirements for these transfers. This knowledge will help you avoid any unexpected issues with tax authorities.

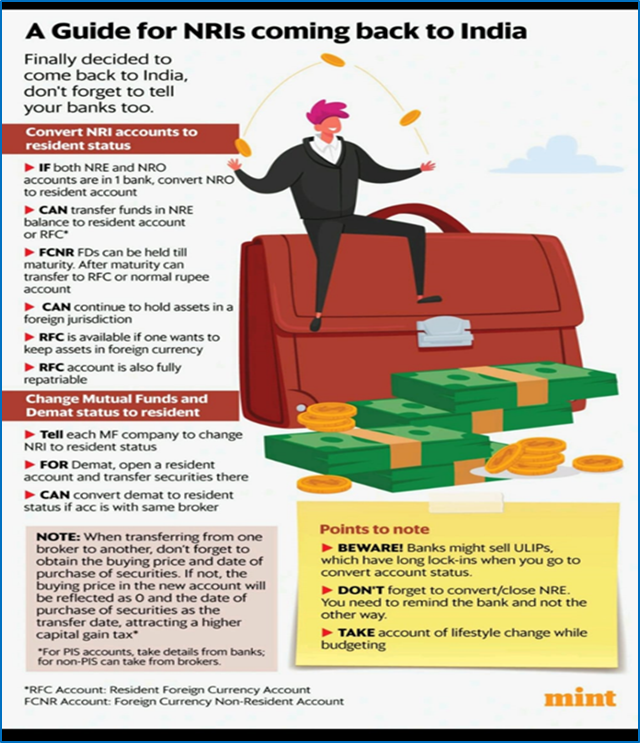

4. Update Your Bank Accounts: Convert your NRE/NRO accounts to resident savings accounts. This process involves paperwork such as updating your KYC (Know Your Customer) details, providing proof of your change in residency status, and submitting necessary forms to your bank.Typically, you will need:

- Proof of Address

- Proof of Identity

- Proof of Residence Change

- Account Conversion Form

5. Review Tax Obligations: Understand your tax liabilities in India. Seek professional advice on double taxation agreements to avoid paying taxes twice on the same income. It's important to know whether you should file an income tax return in India as an NRI.

6. Adjust Investments: Rebalance your investment portfolio to align with Indian markets. Consider local investment opportunities and risks. This adjustment will ensure your investments continue to grow in your new location.

7. Plan for Retirement: Ensure your retirement plans are adaptable to your new location. Consider pension transfers and local retirement schemes to make the most of your retirement savings.

8. Insurance Needs: Update or purchase health, life, and property insurance in India. Understanding the coverage and benefits of these insurance policies will help protect you and your family from unforeseen events

9. Financial Advisors: You plan a strategy for financial stability and growth in India, ensuring a secure financial future Seek advice from a financial advisor familiar with NRI issues. A professional can help.

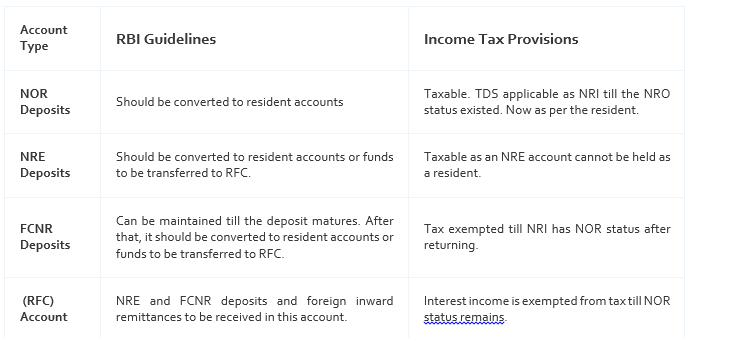

10. Managing your existing Investments in India Demat account: You should inform the bank and broker about your new residency status. You will have to open a new resident demat account and have your existing securities held in your NRI demat account transferred to this account. Subsequently, you will then also have to close your NRI demat account and the NRE Portfolio Investment Scheme (PINS) account. In addition, you will have to do a fresh Know Your Customer (KYC) and update your Foreign Account Tax Compliance Act (FATCA) declaration as applicable for the United States (US) or Common Reporting Standard (CRS) for the United Kingdom (UK), Canada or any of the 100+ countries that have adopted CRS

Mutual funds: You must inform your bank/broker/Asset Management Company (AMC) through whom you have invested in mutual funds about the change in your residency status and have your linked NRI bank accounts updated to a resident savings accounts. You will also have to update your KYC and FATCA/CRS status

Fixed deposit (FD):If you have an FD account, such as an NRE/NRO FD, the account should be converted to a resident FD account. You will still earn interest and the same will be taxable at the applicable tax rates.

Additional Tips for a Smooth Transition

Housing Arrangements

If you don't already have a home in India, research housing options and market trends. Consider renting vs. buying and the legal aspects involved.

Renting can offer flexibility, while buying may be a better long-term investment.

Legal Documentation

Update your legal documents, including visas and work permits. Ensure all personal documents are valid and in order. This preparation will save you time and hassle once you're in India.

Cultural Adjustment

Prepare for cultural differences and social norms. Engage in community activities to ease the transition. Understanding the local culture will help you integrate more smoothly into Indian society.

Networking and Community

Connect with local expatriate and NRI communities. Join social and professional networks for support. These connections can provide valuable advice and support as you settle back into life in India.

Moving Logistics

Plan your move well in advance. Hire reliable moving services and manage customs requirements. This planning will help ensure a smooth transition of your belongings to your new home.

Q1. What are some essential income tax tips for NRIs returning to India?

- Update Your Status: Notify your bank and financial institutions about your change in residential status.

- Understand Residency Rules: Familiarize yourself with the tax residency rules in India

- Claim Exemptions: Utilize available exemptions under the Income Tax Act.

- File Returns Promptly: Ensure timely filing of your income tax returns in India

Q2. What are the key considerations for NRIs regarding their tax obligations upon returning to India?

- ax Residency Status: Determine your tax residency status based on your stay in India.

- Global Income: Understand the tax implications on your global income

- Double Taxation Avoidance Agreements (DTAA): Leverage DTAA benefits to avoid double taxation.

- Document Requirements: Keep all necessary documentation ready for tax filings.

Q3. How does the duration of stay in India affect the tax residency status of returning NRIs?

The duration of stay in India significantly impacts your tax residency status. If you stay in India for 182 days or more in a financial year, you will be considered a resident for tax purposes. NRIs should track their stay to understand their tax obligations better

Q4. What are the tax implications for returning NRIs on their global income?

For returning NRIs classified as residents, their global income becomes taxable in India. However, you can benefit from DTAA (DOUBLE TAXATION AVOIDANCE AGREEMENT) to avoid double taxation. Consulting with a tax advisor can help you manage these implications effectively.

Q5. Are there any tax benefits or exemptions available to returning NRIs?

Yes, returning NRIs can avail of several tax benefits and exemptions, such as:

- Exemption on Foreign Income: Income earned abroad before returning to India is not taxable

- DTAA Benefits: Avoids double taxation on income

- Specific Exemptions: Interest on NRE accounts remains tax-free even after return, under certain conditions.

Q6. What Happens When I Lose My NRI/ NOR Status?

Once an NRI returns to India, his status changes to NOR, which changes to ROR after a few years. Till you enjoy the NRI/ NOR status, you can benefit from the Double Tax Avoidance Agreement that India has with over 75 other countries globally.

However, once your NRI status changes to ROR, you will not be eligible for the returning NRI taxation benefits under DTAA. Moreover, even your global income will be taxable in India henceforth

As part of your income tax planning, if you plan to sell a property you own abroad or withdraw from an overseas retirement account, it is advisable to do it before your status changes to ROR. It will help you avoid paying taxes on it in India.

Tax Regulations and Implications for NRIs Returning to India

Q7. What Should an NRI Do on Returning to India?

- Inform the financial institution and convert your NRE/FCNR account to a resident account.

- Similarly, get your status updated as a resident for your mutual fund investments and open a resident demat account to transfer shares from the existing NRI demat account, if applicable

- An NRE FD can be converted into a domestic resident FD for the same interest rate

Q8. Can NRIs save Income Tax in India With NRI Life Insurance Plans?

- NRIs can purchase an NRI Insurance Policy to get tax benefits along with life coverage benefits to secure their loved ones even when they do not stay in India. An NRI can avail of tax benefits in the following 2 ways with an NRI life insurance plan:

- Deduction under Section 80C: Deduction of up to ₹1.5 lakhs under Section 80C of the Income Tax Act, 1961, for the premium paid towards NRI life insurance plans

- Tax-exempt proceeds: The maturity amount or death benefit received from an NRI life insurance plan is tax-exempt under Section 10(10D) of the Income Tax Act.

However, as the tax laws can change at any time, it is advisable to consult with a tax advisor or financial professional to stay up to date with the latest tax provisions based on your circumstances.

MORE QUERIES

What will be the status of my NRI bank account once I return to India permanently?

Your NRI bank accounts will be converted to resident bank accounts and will be subject to interest earnings and taxations applicable to resident Indians.

Can I get benefits under the provisions of DTAA once I lose my NRI status?

You can continue benefiting under the DTAA provisions till your NRI status remains a NOR status. Once the NOR status converts to a ROR status, you cannot avail of these benefits

For how long can I maintain my NRI account after returning to India?

Once you return to India permanently, Your non-resident status becomes invalid and you become a resident Indian. Therefore, you must inform your financial institution and get your NRE and NRO accounts converted into resident accounts within a reasonable period. Failure to do so can be considered as a violation of FEMA.

FULL FORMS

RNOR- RESIDENT BUT NOT ORDINARILY RESIDENT

NOR- NOT ORDINARILY RESIDENT

ROR- RESIDENT AND ORDINARILY RESIDENT

DTAA- DOUBLE TAXATION AVOIDANCE AGREEMENT

FEMA- FEDERAL EMERGENCY MANAGEMENT AGENCY

FCNR- FOREIGN CURRENCY NON RESIDENT ACCOUNT

RFC- RESIDENT FOREIGN CURRENCY

CONCLUSION

Returning to India after years abroad is a journey that intertwines nostalgia with practical challenges. The allure of familiar sights, sounds, and flavours combined with the promise of a more relaxed and affordable lifestyle makes this transition an appealing choice for many NRIs.However, the process requires meticulous planning, especially in managing finances, updating legal documents, and adjusting to cultural shifts.

By following the comprehensive guide provided, you can navigate the complexities of financial management, investment adjustments, and legal requirements seamlessly. Evaluating your finances, managing currency exchanges, updating bank accounts, and understanding tax obligations are crucial steps to ensure a smooth transition. Additionally, staying informed about housing options, cultural adjustments, and community networking will further ease your homecoming.

Preparation is key to making your move back home as seamless as possible. With this guide you can confidently return to India, knowing you've covered all your bases. Whether you're planning your finances, adjusting your investments, or handling legal documentation, this guide is here to help you every step of the way.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts